Gecko Software, Inc.

271 N. Spring Creek Pkwy. Ste. A

Providence, UT 84332 USA

Phone: 800.862.7193

Email: gecko@geckosoftware.com

Website: TradeMiner.com

Price: $97.00 each version, Stocks, Futures & Forex, no monthly fees.

Requirements: Windows, Mac OS, or Linux200 MB free hard disk space, 1024x768 screen resolution (minimum) Larger recommended. RAM 2GB (more is better). Requires Internet connectivity for installation, but not to run the application itself, CPU: 2.4 GHz or higher.

The TradeMiner software is available for Stocks, Futures, and Forex, and the main premise of TradeMiner is that markets tend to move in cycles and trends, with these cycles and trends tending to repeat themselves over time, and knowing how to recognize these trends, understanding how they work, and paying attention to when they are most likely to occur, will help any trader make more informed trading decisions. Even though this review focuses solely on TradeMiner for stocks, the features of both the Futures and Forex TradeMiner platforms are very similar so many of the features mentioned here are included in those packages as well.

TradeMiner allows you to dig through years of historical stock price data, of all of the stocks that are listed in the S&P 500, the Dow 30, the Nasdaq 100, as well as hundreds more stocks & ETF’s. In addition, the software will sort though this data and help tell you what to trade and when to trade it, with the characteristics of the trade being specified by you. By allowing you to easily analyze the historical price data of these actively traded stocks you will be able to quickly uncover cycles and trends that meet your search criteria. The design of the software makes it easy to get started and, after a short time, the easy-to-use format allows you to navigate the software quickly and easily. Even though the software does have a pretty basic design, making it easy for anyone to use, it has everything that is needed to quickly sort through large amounts of data and uncover investment opportunities.

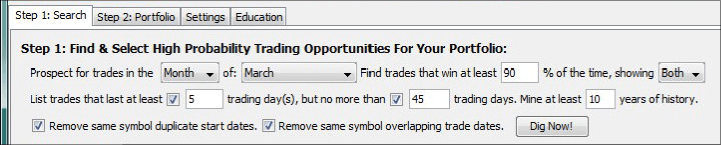

In addition to being very intuitive, the software is also very user friendly. The data that you input is in paragraph format, making it easy to key in your desired search criteria. For example, a typical search would look something like this (with the data in bold being the criteria)… "Prospect for trades in the Month of: April. Find trades that win at least 95% of the time, showing Buy. List trades that last at least 10 trading day(s), but no more than 30 trading days. Mine at least 15 years of history. Dig Now!" You can "dig" through the data according to which month you are looking to find opportunities, what length of trading period those opportunities should be, and what type of order you are looking, as well as the probability of that trade being a winning trade. In addition to looking for any stock within a certain month, you can also mine a specific stock to find out when the best time to trade that stock is, historically.

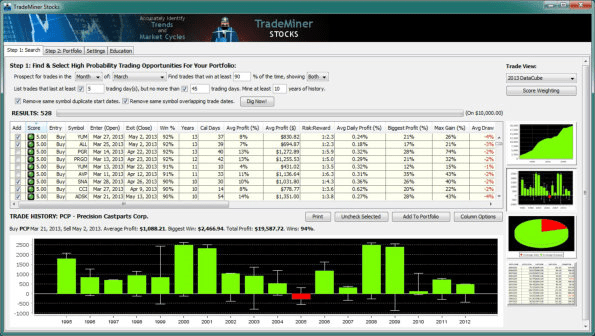

There are two basic steps to the mining process and there are also two basic screens, which includes the "mine" tab and the "portfolio" tab. The "mine" tab is where you input your criteria, as shown in the previous example, and where you get your results. The results are ranked according to the individual score of each trade with the best trades showing up first. You are able to sort the results by the type of position you are looking to take (i.e., buy or sell), the stock symbol the trade, the enter/exit dates of the trade, and many other important trade characteristics. At the bottom of each tab you are able to click through three separate charts, based on which trade you currently have highlighted. These three charts include an equity curve showing the historical return characteristics of the trade, a histogram with year-over-year profit and loss data, and a pie chart that shows the average risk and average reward of the trade.

To provide an example of how easy the software is to navigate, I ran a simulation that mined all of stocks in the S&P 500, the Dow Jones Composite, and the Nasdaq 100. This simulation mined all trades in the month of May, including both buy and sell trades, which lasted at least 5 days but no more than 30 days, and had a 95% success rate as well as a minimum of 12 years of historical data (see figure A-1). After clicking "Dig Now!" it took approximately 40 seconds to mine through all of the stocks and produced a total of 67, with 45 of the results being sell trades and 22 buy trades (see figure A-2). In order to find the most successful trades I sorted the results so that the trades were ranked in descending order with the most successful trades listed first. You can also sort the results by any of the other 31 criteria so that you can quickly filter through the results and find the trades that your investment criteria. Since I typically prefer short-term trades, over long-term trades, but will sometimes trade for longer time frames depending on what trading opportunities are available, I sorted the results by clicking on the "Cal Days" tab so that each trade was listed in order according to the total number of days of each trade.

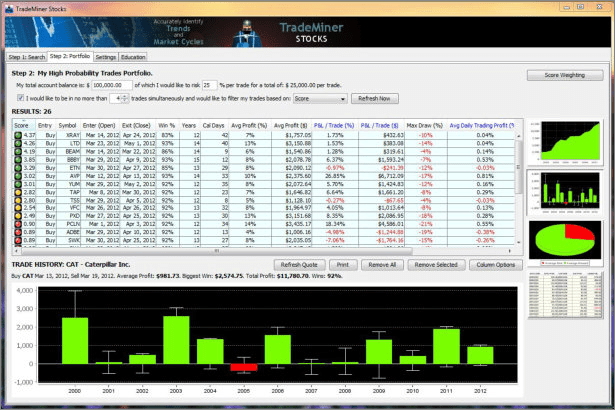

Looking over to the "Score" column, and seeing multiple trades with green dots (which is the color of the highest ranked trades and, by the way, makes it really easy to find the most profitable trades) and even a few with score of 5 (which is the highest numerical score historically possible), I can quickly see that there are many short-term trades to pick from. To screen the trades a bit further I scanned the results for trades that covered different time periods in the month and I also looked for a mix of "Buy" and "Sell" entry orders as well, so that I could find both long and short trading opportunities. I was able to find 8 trades that were spread out throughout the entire month, which will be plenty of trades for me since I tend to have a concentrated portfolio with only a few trades at a time, with five being "Buy" (long) positions and three being "Sell" (short) positions. After checking the box next to each of the trades and clicking the "Add Selected" button, I clicked on the "Step 2: Portfolio" tab to create a portfolio of the trades that I had selected. In the "Step 2: Portfolio" tab I am now able to print either detailed information on each trade or simply a short summary of all of the individual trades that met my criteria. That's it! In a little less than 5 minutes I now have detailed information on 8 trades, which I will trade in the month of May, that have a historically high probability of success.

There are also two more important tabs that I should quickly mention. If you click on the "Settings" tab you can select the universe of stocks that you want the software to mine through, which can simply be all active stocks in each index or one of the individual indexes (as I mentioned earlier, the index options include the S&P 500, the Dow 30, Nasdaq 100, and hundreds of other stocks & ETF’s.

The last tab is the "Education" tab and when you click on this tab your browser will open and you will have access to education material from the TradeMiner website. Since education is one of the most important aspects of successful investing, this is definitely a very valuable feature of the software and it is included in each of the TradeMiner packages. TradeMiner for stocks, specifically, has multiple training videos to help you get started, multiple educational videos, audio interviews with some of the greatest traders of all time, educational PDF lessons, webinars, and a TradeMiner manual that makes it easy to quickly learn the software inside and out.

In summary, TradeMiner is a great tool for any trader who is looking to gain an investing edge by mining through large amounts of historical stock information, analyzing trends and cycles, in order to find potential trading opportunities. Even though the TradeMiner software is based on complex mathematical formulas that allow the software to quickly mine, sort, and organize large amounts of historical data, the simple interface makes using the software so easy that anyone can quickly learn how to navigate the software and can be finding historically winning trades in almost no time at all.

By giving each user the ability identify the market trends and cycles that tend to repeat themselves over time, the TradeMiner software is definitely a must-have for any trader, from beginning traders to seasoned professionals, who is looking for a statistical edge in the markets.

by: Kent Koefoed, Mr. Koefoed is a market technician and research analyst for Gecko Software, Inc.